Blog 3 Columns

- Home

- Blog 3 Columns

Jammu and Kashmir National Conference-led Alliance Wins Assembly Elections After 5 Years0

- News

- October 9, 2024

Jammu and Kashmir’s Political Shift In the first legislative elections since India’s revocation of Kashmir’s semi-autonomy five years ago, the Jammu and Kashmir National Conference (NC) emerged as the dominant force, winning the most seats in the 90-member Legislative Assembly. The NC secured 42 seats, marking a significant political victory. Election Overview The elections, held

READ MORE

Priyanka Chopra Shines in Glamorous Photos from London Trailblazers Event0

Captivating Glamour Priyanka Chopra recently shared a stunning collection of photos from an event in London, captivating her fans with her glamorous looks. The actress, who is currently filming the second season of her web series Citadel, attended the Trailblazers event and showcased her impeccable style. Fashion Highlights In her latest Instagram post, Priyanka displayed

READ MORE

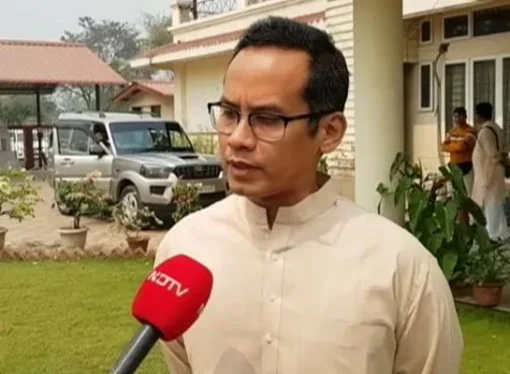

Assam to Reject Himanta Sarma’s Divisive Politics, Warns Congress MP Gaurav Gogoi0

Congress MP Criticizes Chief Minister’s Approach Gaurav Gogoi, a Congress MP from Assam, strongly criticized Chief Minister Himanta Biswa Sarma for allegedly attempting to create divisions between Hindus and Muslims in the state. Speaking at the India Today Conclave in Mumbai, Gogoi emphasized that the people of Assam have the wisdom and capability to reject

READ MORE

Arvind Kejriwal Resigns as Delhi Chief Minister Following Corruption Allegations0

Background Arvind Kejriwal, a prominent political adversary of Indian Prime Minister Narendra Modi, has resigned as Chief Minister of Delhi following his release on bail in a corruption case. Kejriwal, who leads the opposition alliance against Modi, was detained in March over allegations that his government received kickbacks related to liquor license allocations. Interim Leadership

READ MORE

Delhi Records Best Air Quality of the Year After Historic Rainfall0

- Delhi

- September 14, 2024

Record Rainfall Improves Air Quality Delhi recorded its cleanest air quality of 2024 on Friday, following unprecedented rainfall in September. The city’s Air Quality Index (AQI) dropped to 52, placing it at the upper limit of the “satisfactory” category. Neighboring cities, including Faridabad, Ghaziabad, and Noida, also witnessed significant improvement, with AQIs ranging from 24

READ MORE

Rishi Kapoor Reveals Raj Kapoor’s Affair with Vyjayanthimala and Its Impact on the Family0

- Indian Cinema

- September 10, 2024

Introduction Raj Kapoor, a towering figure in Bollywood, is known for his remarkable film career and his tumultuous personal life. In his memoir Khullam Khulla, Rishi Kapoor, his son, sheds light on the significant impact of his father’s affair with actress Vyjayanthimala on their family life. Affair and Family Fallout Raj Kapoor’s affair with Vyjayanthimala,

READ MORE